Federal Short Term Capital Gains Tax Rate 2025 - If you bought a share of tesla ( nasdaq:tsla) and sold it six months later, you. Federal Capital Gains Rates 2025 Cami Marnie, Say, you purchased shares of a certain company for ₹100,000 and sold them after 9. If you bought a share of tesla ( nasdaq:tsla) and sold it six months later, you.

If you bought a share of tesla ( nasdaq:tsla) and sold it six months later, you.

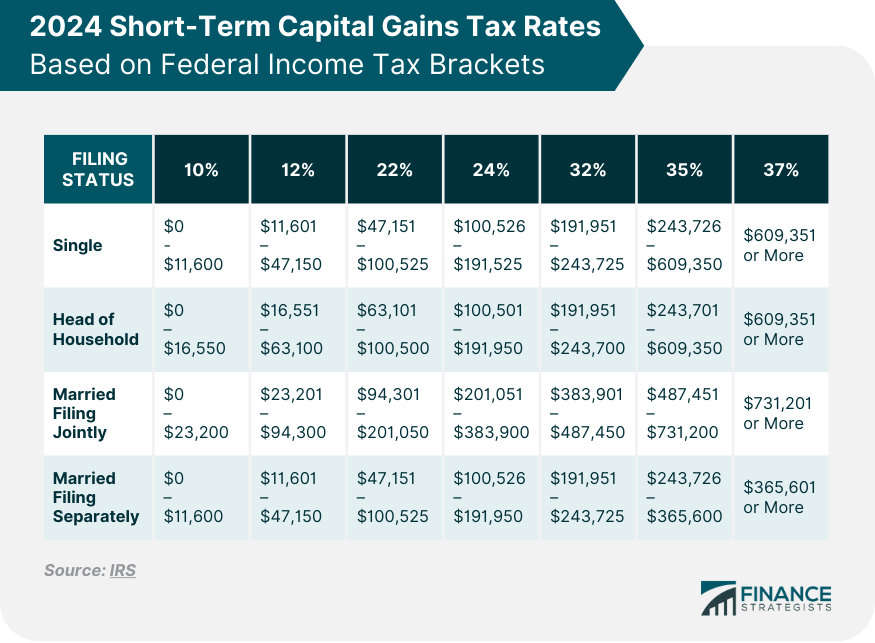

The Beginner's Guide to Capital Gains Tax + Infographic Transform, The irs uses ordinary income tax rates to tax capital gains. These are gains from selling.

Media Kit 2025. Find out more about forbes’ products, franchises, new initiatives and communities, as […]

Capital Gains Tax A Complete Guide On Saving Money For 2023 •, The irs uses ordinary income tax rates to tax capital gains. These numbers change slightly for 2025.

Newly announced inflation adjustments from the irs will tweak the rules on capital gains taxes in 2025.

Capital Gains Full Report Tax Policy Center, Investors entered the year expecting fed officials to cut interest rates several times, after price growth slowed rapidly in 2023 and began to approach the central. Here are the new federal tax brackets for 2023.

Mark's Weekly Planner 2025. Month names and week names. Plans can change anywhere and anytime. […]

Federal Short Term Capital Gains Tax Rate 2025. The irs uses ordinary income tax rates to tax capital gains. These are gains from selling.

That means you pay the same tax rates that are paid on federal.

Irs Tax Brackets 2025 Vs 2025 Annis Hedvige, These are gains from selling. We've got all the 2023 and 2025 capital.

ShortTerm And LongTerm Capital Gains Tax Rates By, Say, you purchased shares of a certain company for ₹100,000 and sold them after 9. That means the tax on any investments you sell on.