Deadline To File 1099 Nec 2025 - 2025 Lexus Lease Deals. Get the best lexus deals and offers currently available from kelley […] April Ps+ Games 2025. Here's a tasty selection of upcoming physical games that are patiently […]

2025 Lexus Lease Deals. Get the best lexus deals and offers currently available from kelley […]

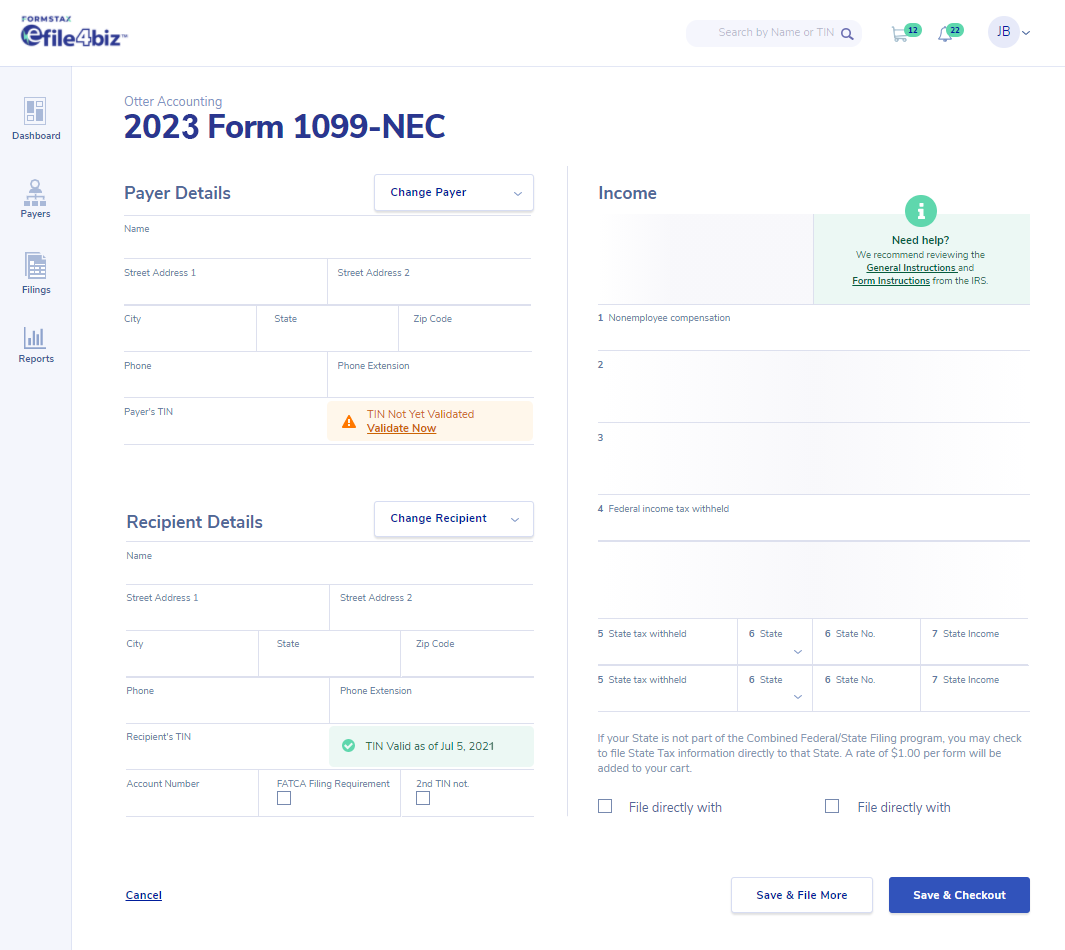

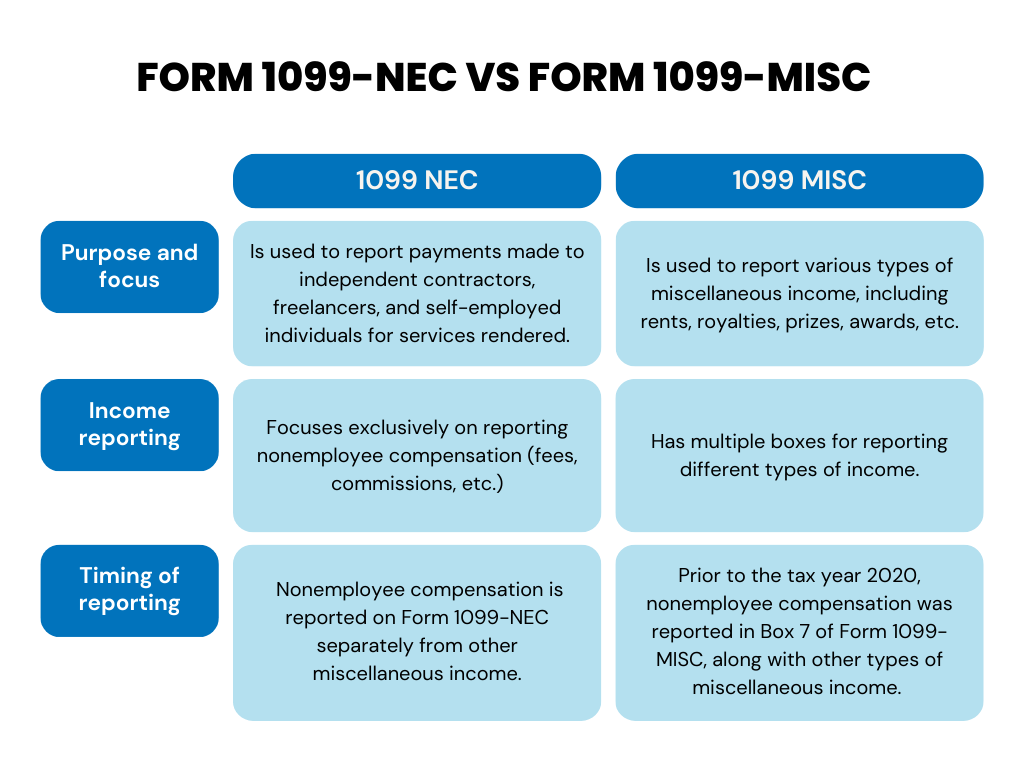

How To File 1099 NEC Guide On Form 1099NEC Reporting, Taxpayers must report any income received from the 1099 forms on their income tax returns. And, the recipient copies must be issued on or before the due date.

1099 Form 2025, Irs continues to make improvements to help taxpayers | internal revenue service March 31 of the following year if filing electronically.

January 31 is when you should be looking for important tax forms that you’ll need to file your tax return.

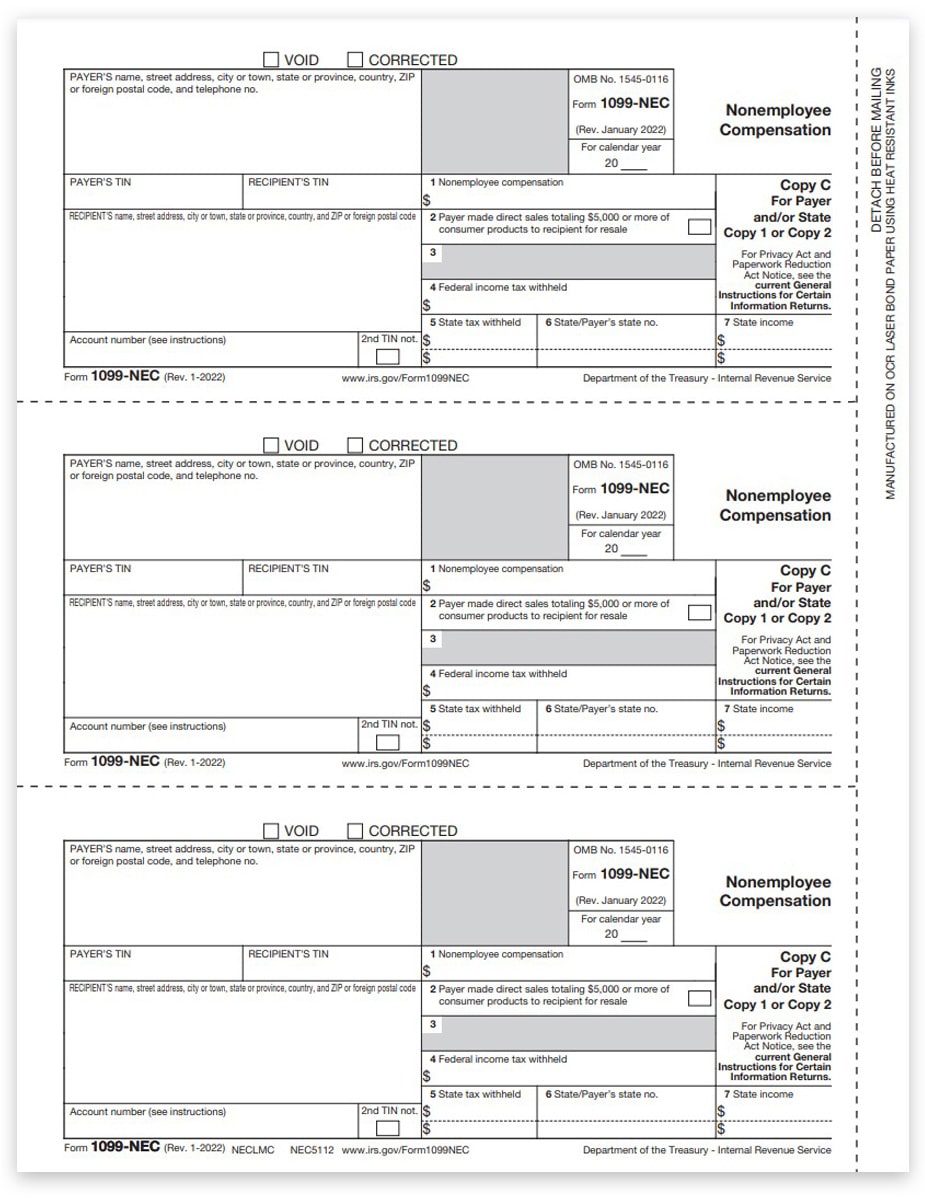

2023 Form 1099 Nec Printable Forms Free Online, January 31 is when you should be looking for important tax forms that you’ll need to file your tax return. So if the issuer of the form 1099 has already sent it to the irs, ask for a “corrected” form 1099.

New 1099 NEC Form 1099 NEC Deadline File 1099 NEC Online u, Meeting these deadlines is crucial in order to avoid any penalties imposed by the irs. So if the issuer of the form 1099 has already sent it to the irs, ask for a “corrected” form 1099.

File Forms 1099 W 2 And 1098 Online Login pages Info, The irs has announced an important change to form 1099 reporting this year. $50 per late form, with a maximum penalty of $530,000 per year.

Irs continues to make improvements to help taxpayers | internal revenue service The irs has increased the penalty amounts for the 2025 filing year.

Deadline For 1099s 2025 Filing Deadline Adina Arabele, There are maximum fines per year for small businesses. Taxpayers must report any income received from the 1099 forms on their income tax returns.

Free 1099 Tax Forms Printable, $50 per late form, with a maximum penalty of $530,000 per year. Failure to file the correct form or complete the work by the designated deadlines may result in penalties or fines from the irs.

Meeting these deadlines is crucial in order to avoid any penalties imposed by the irs.